On 24th January 2023, CapitalRise hosted a improbable occasion on the unique and splendid Whiteley Advertising and marketing Suite in West London. The occasion was attended by round 50 of our traders plus friends from Knight Frank and Finchatton, who joined us for a night of talks and a Q&A on the way forward for the Prime Property market – all accompanied by champagne and canapés.

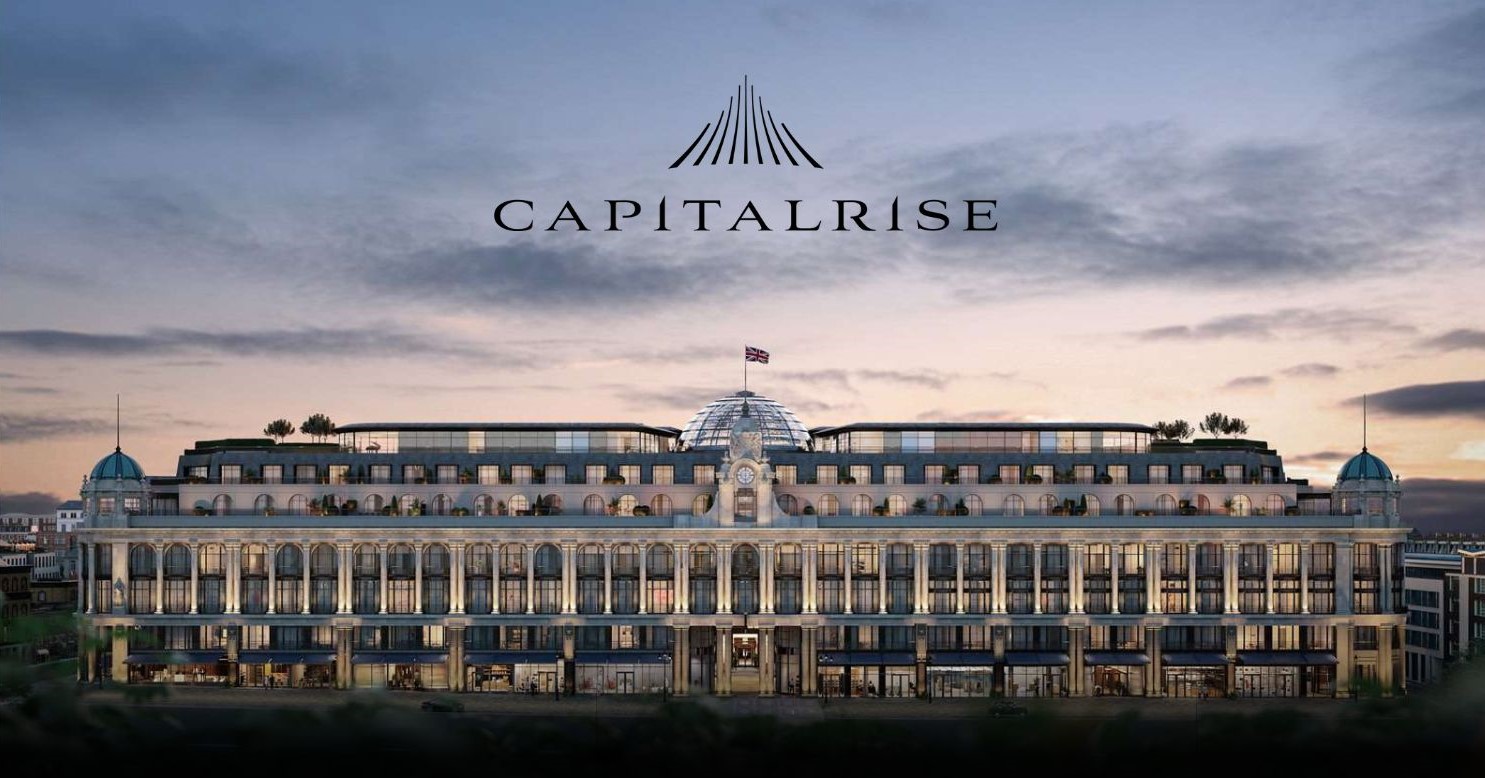

The Whiteley advertising and marketing suite

The Whiteley, our setting for the night, sees the Prime redevelopment of the enduring division retailer, which first opened in 1911. The landmark challenge brings collectively a few of the most gifted architects and builders, who’re respiratory new life into this architectural gem. The masterplan contains non-public residences, the UK’s first Six Senses lodge, and selection eating places, leisure services and retailers.

The friends have been welcomed by CapitalRise CEO and Co-Founder, Uma Rajah. Uma offered the context for the night, with CapitalRise having had an extremely profitable 2022 (for example, finishing extra offers in December than in any month since its inception in 2016). Uma went on to clarify that we anticipate persevering with exponential development within the variety of funding alternatives in 2023, and that we’re excited to see robust development for the enterprise within the coming 12 months.

Uma then launched Liam Bailey, our keynote speaker. Liam is the International

Head of Knight Frank’s Analysis Division, chargeable for creating enterprise

intelligence and buyer perception programmes. He leads and co-ordinates

initiatives within the UK and internationally for shoppers, together with builders,

traders and funders. Over the previous decade, he has led the event of

Knight Frank’s wealth analysis stream – culminating within the annual Wealth Report

publication.

His discuss lined a spread of subjects regarding

the PCL (Prime Central London) outlook for 2023 and past. Some key takeaways

included:

- Although 2022 UK home costs fell (-4.3%), within the world context greater charges imply asset costs are underneath strain in most locations. As an example, throughout the identical interval, we have now seen a -3.0% worth drop within the USA, -7.4% in Hong Kong, and -15.2% in Sweden.

- The home housing market has inner variations to think about, with PCL out-performing the broader UK market. Whereas the general UK 2-year cumulative change (2023-4) is predicted to be -9.8%, PCL pricing is anticipated to scale back by much less at -3.0%. Equally, trying ahead to 2025-7, the cumulative change for each PCL and Larger London is predicted to develop by +11.4%, in comparison with +8.7% for the UK as an entire.

- Liam recognized 5 key causes why PCL is predicted to outperform:

- Provide: Compounded by the truth that each the variety of properties underneath development and completions are the bottom since 2014, whereas the variety of gross sales is at its highest since 2017.

- Demand: Being pushed by the top of Covid restrictions, notably from China, which noticed a dramatic discount in worldwide guests. As an example, when evaluating December 2022 to 2019, the variety of arrivals at Heathrow from the EU dropped by 14%, and from Asia/Pacific by 25%. As these areas open up, we’re seeing an increase in demand once more.

- Relative worth: The relative worth of London is supported by the info too, with PCL seeing an 18% drop in worth since January 2015.

- Worldwide consumers: This relative worth is made much more enticing to worldwide consumers with the drop within the worth of the pound, successfully providing a 35% ‘low cost’ for US Greenback and 27% for Chinese language Yuan consumers in comparison with August 2015.

- Funding demand: Extra broadly, there may be funding demand. Knight Frank’s Wealth Report calculates that 23% of UHNWIs want to property investments to defend their portfolios and in the hunt for revenue.

Following the talks, we hosted an illuminating Q&A. Our traders requested questions on a spread of subjects: from the impact of potential stamp obligation modifications, the impression of a Labour election win, to the relative significance of various worldwide markets in a post-Covid world.

We wish to say a giant thanks to our companions at The

Whiteley, Finchatton and Knight Frank – and naturally to our improbable traders

for making the night each satisfying and informative. We hope to see you at

the following CapitalRise occasion!

![Ouch! Here is What Hurts Your Credit score Rating [INFOGRAPHIC] | CASH 1 Weblog](https://www.cash1loans.com/Portals/0/Images/blog/credit/credit-repair-what-hurts-your-credit-score-f.png?ver=qj8tbZZMl_eFnnvJTEcv0g==)