With the appropriate monetary strikes, you possibly can create smoother crusing within the 12 months forward. Should you aren’t positive the place to get began with getting ready your funds, you might be in the appropriate place. We’ve created a guidelines that can assist you breeze by the steps of getting ready your funds within the new 12 months.

The best way to Put together Your Private Funds for the New 12 months

As the top of the 12 months comes round, it’s a helpful time for reflection throughout many areas of our life. After all, many people replicate on our progress towards well being and happiness over the past 12 months. Nevertheless it’s additionally time to evaluate your monetary scenario and set monetary targets for the approaching 12 months.

Test Your Credit score

A credit score rating is a three-digit quantity that may have a big effect in your monetary life. Basically, your credit score rating is a mirrored image of your credit score report. You probably have good info in your credit score report, like on-time funds, this results in credit score rating. However when you’ve got a spotty fee document or in any other case mismanage your credit score, you’ll doubtless have a decrease credit score rating.

A great credit score rating could be a boon in your funds. Not solely will it aid you achieve entry to extra enticing financing alternatives, however it could additionally aid you lower your expenses throughout different payments, like insurance coverage premiums.

Step one to constructing credit score rating is to see the place you stand. Fortunately, there are methods to verify your FICO rating without cost.

Decide Your Internet Value

Your internet price gives a snapshot of the present state of your funds. Working the numbers in your internet price is a useful train. You’ll be able to calculate your internet price by subtracting the sum of your liabilities from the sum of your property.

Liabilities embrace what you owe, like bank card balances and automotive loans. Alternatively, property embrace what you personal, just like the fairness in your house, money in a financial savings account, investments, and extra. In case your liabilities outweigh your property, then you definately’ll have a unfavorable internet price, however when you’ve got extra property than liabilities, you’ll have a constructive internet price.

Right here’s an instance of tips on how to calculate internet price. Let’s say that Sally has $1,000 in bank card debt, $15,000 in scholar mortgage debt, $15,000 in a financial savings account, and $2,000 in an employer-sponsored retirement account. By including the $15,000 of financial savings and $2,000 of investments and subtracting the $15,000 in scholar mortgage debt and $1,000 of bank card debt, we will see that Sally’s internet price can be $1,000.

Usually, it’s useful to set internet price targets for your self as part of your monetary plans. As you progress by the years, revisiting your internet price may also help you monitor your progress.

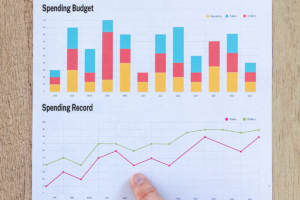

Assessment Your Spending![Spending review chart]()

The way you spend your cash has a significant impression in your monetary future. Nonetheless, it’s straightforward to lose observe of what you spend your cash on. You doubtless know the large prices in your finances, like hire or a automotive fee. However you won’t know precisely how a lot cash you spent on meals or enjoyable this 12 months.

Reviewing your spending may give you a transparent understanding of the place your cash goes. Should you spend with a bank card or debit card, including up the whole spent must be as straightforward as combing by your financial institution statements. However some bank card issuers make it simpler by providing spending critiques for you.

Hopefully, you’ll be happy together with your spending selections. However for many of us, this train will illuminate an space that has room for enchancment. For instance, you would possibly understand that your entire takeout nights are taking on an excessive amount of of your finances. Otherwise you would possibly decide that you’re spending an excessive amount of on subscriptions that you simply don’t use usually.

Plan For Subsequent 12 months’s Bills

As you look into the subsequent 12 months, you might need an concept of among the large bills coming down the pipeline. Relying in your scenario, you would possibly foresee transferring prices, a trip, a down fee in your subsequent automotive, or an enormous vacation reward. Whatever the bills coming your manner, map out a plan to save lots of for them.

You probably have a timeline for these prices, attempt to get away your financial savings wants into weeks or months. For instance, let’s say you wish to plan for a $1,200 trip in 6 months. You’ll want to save lots of $200 per thirty days to make that purpose occur.

Make a Plan to Enhance Your Credit score

After you have an concept of the place your credit score rating stands, you possibly can resolve on the subsequent steps. If you’re trying to enhance your credit score rating, you would possibly begin by making on-time funds a precedence or paying off excessive bank card balances.

As with most issues in private finance, bettering your credit score can take time. As an alternative of on the lookout for rapid outcomes, implement good credit score administration methods. For instance, constructing a document of on-time funds may have a constructive impression in your credit score over time.

Create Your Private Finance Price range![Budget planning]()

A finances is a cornerstone for a profitable monetary future. Though many see budgets as a constraint on their spending, it’s useful to take a look at a finances as a helpful monetary device. The long-term implementation of a well-thought-out finances can set you up for a cushty monetary life. And not using a finances, it’s simpler to overspend on issues that don’t essentially matter to you.

A finances ought to embrace all the pieces out of your fundamental must your long-term financial savings targets and hobbies. For instance, you would possibly resolve to allocate $100 per thirty days to your favourite pastime. However this alternative would possibly require giving up $100 in spending on takeout.

If you lay out a finances, it’s simpler to see how your spending may also help you attain your monetary targets, or forestall you from making any progress. As you construct your finances, attempt to not be too restrictive in your spending. For instance, if you happen to love a specific pastime, don’t fully remove it out of your spending. As an alternative, discover methods to trim again in different methods so as to proceed to spend on one thing that brings you pleasure. If attainable, construct a finances that aligns your spending together with your values.

Make a Plan to Pay Down Debt

Debt is usually a needed a part of constructing a life. For instance, most Individuals merely can’t buy a home or car in money. In terms of these big-ticket objects, taking out debt supplies a pathway to proceed transferring by life. Nonetheless, debt places a pressure in your funds.

The excellent news is that it could be attainable to repay your debt early. Should you dream of claiming goodbye to your month-to-month funds, then begin making a plan to pay down your money owed.

Most select between the snowball and avalanche strategies when paying down debt.

The snowball technique requires paying off money owed so as from the smallest stability to the best stability. As you remove money owed, you possibly can roll its month-to-month fee to your debt snowball for the subsequent largest debt. You’ll deal with greater and greater money owed because the snowball grows.

The avalanche technique places a deal with the money owed with the best rate of interest. You’ll begin by paying off the debt with the best rate of interest. As you remove money owed, you possibly can roll the month-to-month fee into your debt with the subsequent highest rate of interest.

Though the avalanche technique is extra mathematically environment friendly, the snowball technique would possibly present extra psychological wins alongside the best way. The fact is that following by on both technique will result in a debt-free standing. With that, getting began is extra necessary than selecting the “good” technique.

Begin an Emergency Fund

An emergency fund could be an important level in your private finance guidelines. The previous few years have pushed dwelling the purpose that life can throw sudden curves your manner at any second. We will’t know what life will throw our manner subsequent. However we will put together for the unknown by constructing an emergency fund.

An emergency fund is a stash of money that you may fall again on to cowl sudden bills or recalibrate after a change to your earnings. Sometimes, specialists advocate conserving between three to 6 months’ price of bills saved in your emergency fund. For instance, a family spending $2,000 per thirty days would ideally have an emergency fund of at the least $6,000 to $12,000 available.

After all, increase these financial savings is simpler mentioned than carried out. Nevertheless it could be price making this a prime precedence in your funds subsequent 12 months. When you might have an emergency fund stocked up, you’ll be capable of deal with loads of the sudden prices that life throws your manner. For instance, in case your automotive wants alternative elements, you possibly can pay for them with out going into debt. Or if you happen to lose your job, you might have just a few months to determine issues out earlier than it’s good to resort to your bank card.

Get Prepared for Tax Season

Tax seasons can go extra easily if you happen to collect the mandatory paperwork forward of time. A couple of of the paperwork it’s good to accumulate embrace your earnings varieties, enterprise bills, final 12 months’s tax returns, academic bills, and a document of your tax-deductible transactions.

As your employer sends tax paperwork your manner, accumulate them in a particular folder to make tax season simpler. If that you simply’ll owe cash to the IRS, put aside the mandatory funds in a particular account. You don’t wish to by accident spend the funds you owe to Uncle Sam.

Assessment Your Insurance coverage Protection

Insurance coverage insurance policies shield your monetary scenario. Though your premiums could be an enormous line merchandise in your finances, the protection is usually a worthwhile safeguard in your funds. For instance, automotive insurance coverage may also help you cowl the restore or alternative prices in your car after an accident.

Take the time to evaluate your entire insurance coverage insurance policies to ensure you have sufficient protection. A couple of of the frequent insurance coverage insurance policies you would possibly want embrace medical insurance, automotive insurance coverage, home-owner’s or renter’s insurance coverage, life insurance coverage, incapacity insurance coverage, and long-term care insurance coverage.

Along with ensuring that your insurance policies present sufficient protection, you must evaluate the premiums tied to your insurance policies and search for any reductions. Purchasing round in your insurance coverage coverage can usually result in financial savings. Sometimes, you possibly can lock in a decrease premium by elevating your deductible. However don’t elevate your deductible larger than what you possibly can moderately afford to pay after a declare.

Contemplate Lengthy-term Financial savings Targets

Final however not least, the start of the 12 months is an effective time to evaluate your long-term financial savings targets. Sometimes, long-term financial savings targets embrace issues like constructing a retirement nest egg or saving for a house buy. Though most of us hope to retire, it’s usually difficult to remain on prime of your financial savings plan.

In the beginning of the 12 months, reassess your financial savings targets. Should you don’t have long-term financial savings targets, now is an effective time to set them. If you have already got financial savings targets, monitor your progress over the past 12 months to see if you happen to’re on observe to fulfill your targets or if it’s good to reassess your strategy.

Incessantly Requested Questions

You’ve questions on getting ready your funds for the 12 months forward. We’ve solutions.

How Can I Enhance My Credit score Rating within the New 12 months?

The brand new 12 months represents a contemporary begin for a lot of areas of your life. However the info in your credit score report will carry into the brand new 12 months. There are a lot of methods to enhance your credit score rating. However among the only methods embrace making on-time funds a precedence, paying down high-balance bank cards, growing your credit score limits, and credit score piggybacking.

Discover extra info on constructing credit score in our full information to credit score hacks.

What Is the 50/20/30 Cash Rule?

The 50/20/30 cash rule is a budgeting technique that may aid you keep wholesome spending boundaries. In line with the rule, you possibly can spend as much as 50% of your earnings on needed bills like housing and transportation. 20% is devoted to repaying debt and financial savings, whereas the remaining 30% is allotted for discretionary spending.

If you implement this cash rule, it might probably aid you keep on observe towards main monetary targets.

The Important Private Finance Backside Line Test-in

The beginning of the 12 months is an effective time to run by a private finance guidelines. With the appropriate perspective, you possibly can verify off all the objects on this listing. Though a few of these duties would possibly really feel like a chore, getting ready for a financially profitable new 12 months begins with the objects on this guidelines. Get began at present!

![Ouch! Here is What Hurts Your Credit score Rating [INFOGRAPHIC] | CASH 1 Weblog](https://www.cash1loans.com/Portals/0/Images/blog/credit/credit-repair-what-hurts-your-credit-score-f.png?ver=qj8tbZZMl_eFnnvJTEcv0g==)